Table of Content

Am satisfied with their customer service and response . EMIs can sometimes be changed based on the borrower’s income. In step up EMI, there is a gradual rise in the EMI based on the increase of the borrower’s salary. In this case, the EMI charged in the initial part of the loan tenure is low and over time it increases with the expected increase in the borrower’s income.

Home loans are borrowed from financial institutes for buying, constructing, extending, or renovating a house. The loan gets paid with interest over a fixed tenure through Equated Monthly Instalments . You pay the balance 10% as a down payment towards the loans. Your monthly income, credit score and history, and existing loans’ details will be considered by the bank before offering you the final financing amount. Long back during the year 2001, I was holding this housing loan from GRUH, I had purchased a new flat for that purpose I availed this loan .

Home Loan by Top Banks

The Piramal Finance home loan calculator breaks down the interest and principal payments in detail. You can do that by using BankBazaar Bandhan Bank Home Loan EMI Calculator. The entire process is simple and hassle-free with a quick turnaround time. Just enter all the details pertaining to your loan, including the processing fee, amount, interest rate, and tenure. Now click on the button “calculate” to check your EMI. You can also view your monthly repayment schedule via an amortisation table.

Gruh Finance offers loan up to maximium75% or 80% or 85% of the property cost linked to the loan amount as per NHB guidelines. Our loan and financial assistance is extremely flexible to match the timely satisfaction of our customers. Tenor- The tenor is the length of time you have to repay your mortgage. The tenor of your loan is inversely related to the EMIs, therefore the lower the EMIs, the longer the tenor.

Home Loan Emi Calculator

Gruh finance offered me 10.25% of interest on home loan, I felt it was higher side. Their customer service is also not upto the mark there was no communication or interaction about reversed interest rate. Their charges are fine only concern about the interest. Annual reducing method – In this method, borrowers are required to pay the EMI every month.

Buying a home is one of the biggest decisions in life. Also, it carries anxiety and frustration in gathering insights but ends up with a huge sense of accomplishment. With the sky-rocketing property prices, it becomes tedious to buy a home through your savings entirely. So one has to focus on home loan as a reliant option for pursuing your dream home. I took a Home Loan of about Rs.9 Lakhs from this Financiers.

Mistakes that people make with home loan calculator

Easily generate your invoice or other bills due for payments. There is no upper limit on the number of times one can use the calculator. All you have to do is insert a few necessary details, and the calculator will do the rest. There are numerous advantages of using the calculator available at this website. It gives you an accurate estimate, which is pivotal for financial planning.

If you work with a sole proprietorship or a partnership firm, even then you can get a loan of up to Rs 75 lacs. Even if you receive salary by cash, you can get a loan of up to Rs 20 lacs. The loan amount can go up to Rs 30 lacs if there is a co-applicant.

They don’t want defaults in their home loan portfolios. The maxgain calculator allows you to calculate the savings in comparison to regular home loan. Pay the processing fees which lenders require for creating your account. Most of the home buyers enter the exact selling amount to calculate EMI. But, they should remember that the home loan will be approved for only 80% of the total cost. Moreover, they need to add other expenses such as – stand duty, registration and tax to get accurate EMI.

Offered to professionals and salaried persons for purchase/construction of residential units, based on income proof of individual. If you can get a loan under a regular product from a bank or an HFC, try those options first. If you don’t get a loan at such places and must still buy a house to stay in, you can consider this option or other similar options. The processing fee for the home loan can be up to 3% of the loan amount + taxes. Difficult to make out from the website if this product is more expensive compared to other home loan products from Piramal Capital.

However, the interest rate and principal amount is computed at the year’s end. SBI Flexipay Home loan provides an eligibility for a greater loan. It offers customer the flexibility to pay only interest during initial 3-5 years and thereafter in flexible EMIs.

Given the high price of real estate in India, purchasing a house can be a challenging task without an external source of finance. An increasing number of prospective home buyers are opting for this type of credit to fund their house purchase. It is no surprise that housing credit grew by over 16% in FY18. Gruh Finance Limited offers variable rate of interest, semi fixed rate of interest and fixed rate of interest. The variable rate of interest is linked to the Prime Lending Rate announced by Gruh from time to time. Plan your housing finance efficiently using the Eligibility Calculator to check the loan amount you can apply for.

This variant of SBI home loan is very useful for young salaried between years. The Flexipay calculator allows you to calculate the EMI division that you pay during the home loan tenure. The Piramal Finance home loan calculator makes determining your home loan EMI simple. The home loan interest calculator can assist you in choosing a wise decision about purchasing a new home. The EMI calculator can also help you plan your finances on a monthly basis. Piramal Finance offers a pleasant home loan EMI for you by offering a low interest rate and a long payback period.

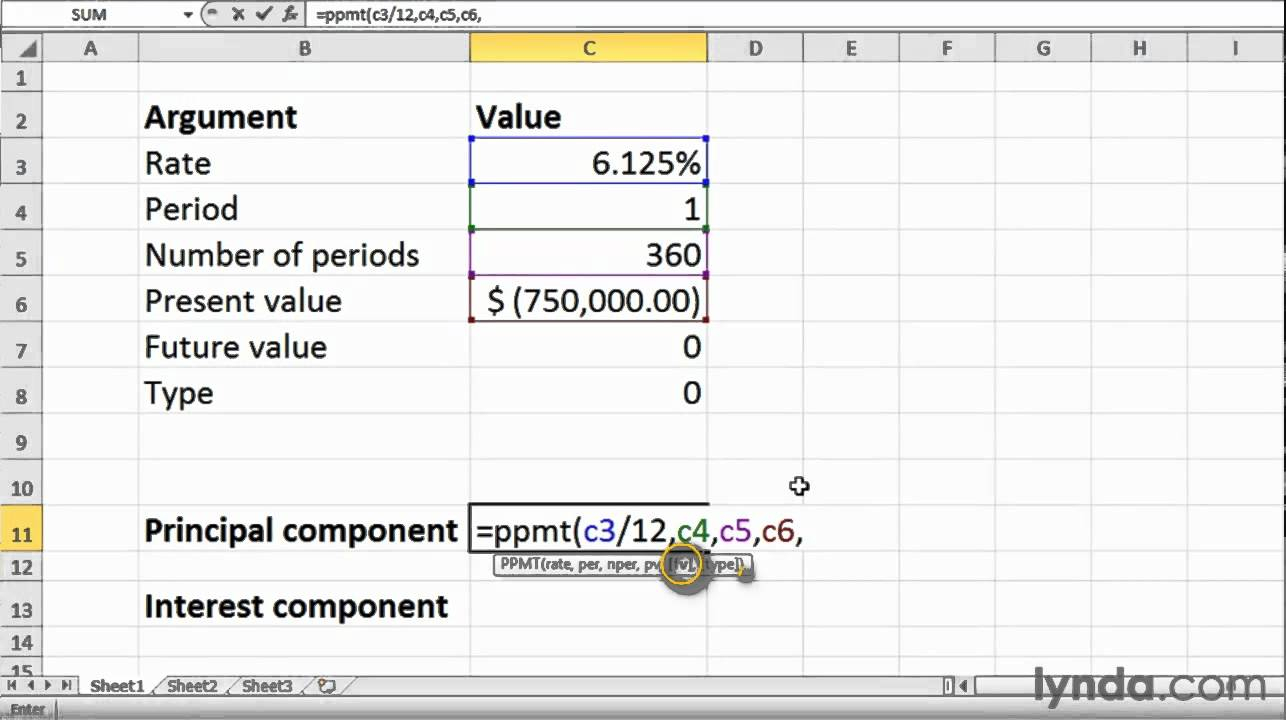

Explore your dream house from a bouquet of exclusive products designed for each customer segment. Now, each loan EMI has two components – a principal component and an interest component. At the beginning of the tenure, the interest component is high, and the principal part is relatively low. The equation changes with every passing month, as the total interest to be paid reduces faster. So, with every EMI paid, the interest component decreases while the principal component increases.

All you need to know about your home loan

Self-Employed Non-professionals, Business owners, Proprietorship, Partners of partnership firms and Promoters/directors of private and public limited companies. Piramal Capital & Housing Finance has launched a home loan product in tie-up with Indian Mortgage Guarantee Company . There is no limit on the number of times you can use it. So, you can quickly check the EMI for different home loan amounts. Saves the valuable time of prospective home buyers. Can do these complex calculations in no time, and save you from the trouble of doing it manually.

No comments:

Post a Comment